Discover what car rental appear having good 650 credit get. Learn the steps you can take locate a low interest rate mortgage and discover just how to change your credit score from 650

Your credit score is really what mainly establishes if or not you get borrowing from the bank or perhaps not and if the eye cost offered to you are going to https://paydayloanalabama.com/weogufka/ feel highest or reasonable. A credit score is actually lots that is computed on the advice found in your credit score having fun with a statistical algorithm. The newest ensuing amount keeps around three digits and selections regarding three hundred to 850.Everything on the credit report try amassed regarding the borrowing from the bank bureaus Transunion, Experian, and you may Equifax.

The financing scoring system try produced from inside the 1989 by the Reasonable, Isaac, and you will Team, currently known as FICO. Since then, the fresh FICO model might have been accompanied by the a lot of borrowing from the bank grantors and you can finance companies.

Based on FICO, 90% of the very legitimate and recognized loan providers today are making choices centered on this credit reporting program.

The following companies are the preferred companies that that level fico scores: FICO, VantageScore, Plus Get, TransUnion, Experian National Equivalency Get, Equifax, CreditXpert, and you can ScoreSense.

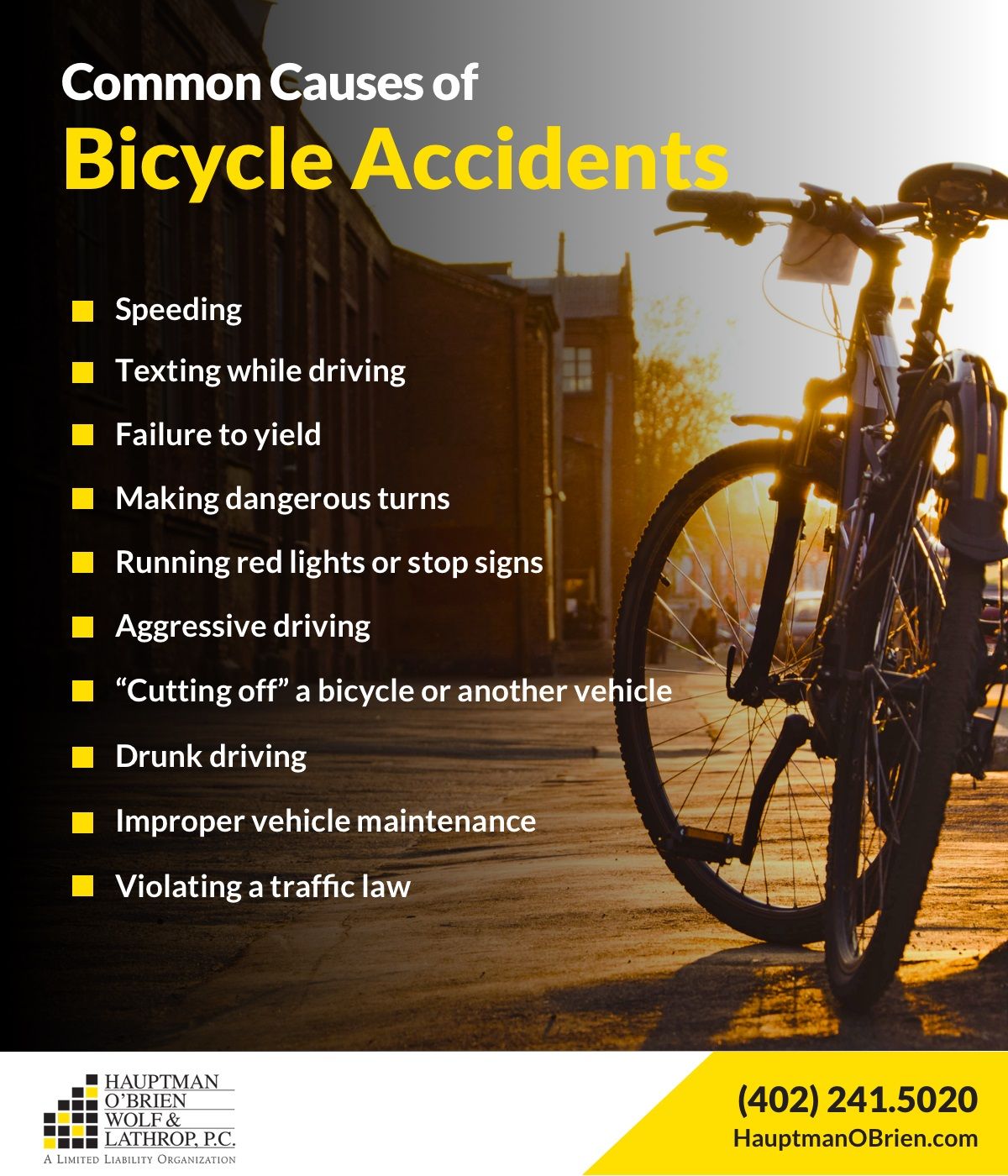

Fico scores are typically made use of whenever obtaining money, such student education loans, signature loans, auto loans, small business financing and. Landlords explore credit rating to decide if you can manage to rent an apartment. Insurance companies put it to use to decide simply how much so you can fees getting visibility. Even particular mobile phone and you will electric people play with fico scores. It is utilized by financial institutions, borrowing grantors, stores, landlords and different version of lenders to choose how creditworthy you is.

Which have a good credit score ensures that you can aquire people investment you you would like or rent people apartment you prefer. Just in case you are looking at appeal, you will be offered a reduced interest levels. On the other hand, which have a bad credit rating implies that you’re declined different types of borrowing from the bank. Loan providers will truly see you as the an extremely risky debtor and will perhaps not agree the loan application. Also some landlords usually reject your a lease should your credit rating is bad.

Auto rental with a 650 credit score

A credit history regarding 650 was classified given that reasonable. This will make your qualified to receive most of the old-fashioned loans. However, the attention pricing might not be a knowledgeable. Below are a few of creditors that will be ready to invest in your car or truck local rental.

Friend Financial

The financial institution requests at the least a credit history out-of 620. It means your slide higher still and will get better rates especially if you decide to complete the payment in less than forty weeks.

Bank from The usa

The financial institution needs no less than a credit history regarding 600. The ple to possess Colorado State really stands within step three.09% to possess 60 months. In addition, you stand to get coupons whenever you are a part of your own standard bank doing 0.50%.

Fifth 3rd Bank

The lending company need at the very least a credit rating out-of 640. Their attention price vary from 5% so you can ten% based on if the automobile is completely new or used, percentage terms and conditions, advance payment and you will county.

Just how is actually my personal 650 credit rating calculated?

Lenders need to courtroom while a cards-deserving private in advance of they give a loan otherwise whichever resource you prefer. And here your credit comes in useful. Really lenders look at the FICO get, since it is the most commonly used credit history, to choose your own borrowing-worthiness. This new specifics of how FICO assess the fresh new rating commonly identified, nevertheless all of the boils down to the information on your borrowing from the bank declaration. Your credit score is made up of next components: percentage records (35%), extent due (30%), the length of credit score (15%), the latest credit (10%), and sort of credit made use of (10%).