Under specific identification, the cost of goods sold is 10 + 12, the particular costs of machines A and C. If she uses average cost, her costs are 22 ( (10+10+12+12)/4 x 2). Thus, her profit for accounting and tax purposes may be 20, 18, or 16, depending on her inventory method.

Why You Can Trust Finance Strategists

A business will often charge the inventory write-off to the cost of goods sold (COGS) account If the inventory write-off is immaterial. The problem with charging the amount to the COGS account is that it distorts the gross margin of the business because there’s no corresponding revenue entered for the sale of the product. It is important to realize that unearned revenue is not a contra revenues account. The balance is held as a current liability (credit) on the balance sheet of the business. Materials and labor may be allocated based on past experience, or standard costs. Where materials or labor costs for a period fall short of or exceed the expected amount of standard costs, a variance is recorded.

Ask Any Financial Question

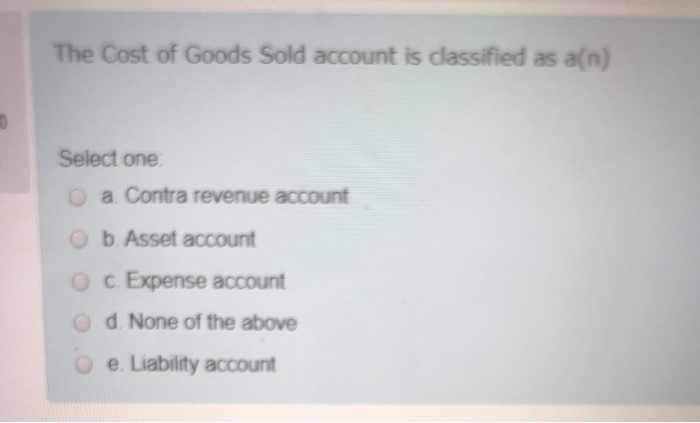

Therefore, for these three, the debit balance actually represents a negative amount. COGS is reported on the income statement as an expense item, deducted from revenue to calculate gross profit. Reporting COGS accurately is crucial for generating reliable financial statements and assessing a company’s profitability. Cost of goods sold is a critical concept in accounting that impacts a company’s financial statements, profitability, and tax reporting.

Inventory Write-Off: Definition As Journal Entry and Example

- The contra-account of FinishedGoods is used in External Accounting only at month end.

- He sells parts for $80 that he bought for $30, and has $70 worth of parts left.

- Once sales are made, not only sale revenue and account receivable are affected by this transaction.

- The other account that will be affected the same amount as finished goods is the cost of goods sold.

Key examples of contra asset accounts include allowance for doubtful accounts and accumulated depreciation. Accumulated depreciation reflects the reduction in value of a fixed asset. The benefit of using the contra expense account is that the company’s managers can see in account 4210 the total amount that the company paid to the health insurance company.

Trial Balance

For example, if a piece of heavy machinery is purchased for $10,000, that $10,000 figure is maintained on the general ledger even as the asset’s depreciation is recorded separately. Large, recurring inventory write-offs can indicate that a company has poor inventory management. The company may be purchasing excessive or duplicate inventory because it’s lost track of certain items or it’s using existing inventory inefficiently.

What Is an Inventory Write-Off?

There are four key types of contra accounts—contra asset, contra liability, contra equity, and contra revenue. Contra assets decrease the balance of a fixed or capital asset, carrying a credit balance. Contra liabilities reduce liability accounts and carry a debit balance. Contra equity accounts carry a debit balance and reduce equity accounts. Contra revenue accounts reduce revenue accounts and have a debit balance. To illustrate, let’s use the contra asset account Allowance for Doubtful Accounts.

A contra liability account is not classified as a liability, since it does not represent a future obligation. Accountants use contra accounts rather than reduce the value of the original account directly to keep financial accounting records clean. If a contra account is not used, it can be difficult to determine historical costs, which can make tax preparation more difficult and time-consuming. A business will record a credit to the inventory asset account and a debit to the expense account using the direct write-off method.

These standards govern how financial statements are prepared by organizations, companies, governments, and nonprofits. Obsolete inventory is an item or items that a business can no longer sell. They may have been replaced in the marketplace by an improved or less expensive product or model. Businesses are consequently is cost of goods sold a contra account forced to write off or write down their value or cost in their accounting records. COGS should be calculated for each accounting period, typically monthly, quarterly, or annually. Regular calculation of COGS ensures accurate financial reporting and provides insights into the cost structure of the business.