Mastering Forex Swing Trading: Strategies for Success

Forex swing trading offers a unique opportunity for traders to capitalize on market movements without the need for constant monitoring. This trading style focuses on capturing shorter-term price shifts, making it an appealing option for those who cannot commit to day trading. For detailed insights and resources, visit forex swing trading https://latam-webtrading.com/. In this article, we will explore the fundamental aspects of forex swing trading, including strategies, risk management, and key techniques to enhance your trading potential.

Understanding Swing Trading

Swing trading is a strategy that aims to capture the “swing” within price movements. Unlike day traders who open and close positions within the same trading day, swing traders typically hold trades for several days to weeks. This allows them to take advantage of price corrections and reversals, which often occur in fluctuating markets.

Key Characteristics of Forex Swing Trading

- Timeframe: Swing traders usually operate on longer timeframes, such as 1-hour, 4-hour, or daily charts. This provides a broader perspective of market trends and potential price reversals.

- Analysis: Swing traders rely heavily on technical analysis to identify potential entry and exit points. Common indicators used include moving averages, RSI, and Fibonacci retracement levels.

- Risk Management: Effective risk management and a well-defined trading plan are critical in swing trading. Traders often set stop-loss orders to safeguard their capital.

Popular Strategies for Swing Trading

1. Trend Following

One of the simplest and most effective swing trading strategies is trend following. This involves identifying the prevailing market trend and entering trades in the direction of that trend. Traders use indicators like moving averages to help identify trends and confirm entry points. For instance, if the price is above a moving average, a trader may look for buying opportunities.

2. Reversal Trading

Reversal trading aims to capture price reversals in the market. Traders look for signs that a trend is losing momentum and a reversal is likely to happen. Key indicators for this strategy include candlestick patterns, divergence signals on the RSI, and overbought/oversold levels. Successfully identifying a reversal can lead to profitable trades, but it requires patience and experience.

3. Breakout Trading

Breakout trading involves entering a trade when the price breaks out of a defined resistance or support level. This strategy capitalizes on the momentum that often follows a breakout, allowing traders to capitalize on significant price moves. To increase the chances of success, traders may look for higher volume during a breakout, which suggests strong market commitment.

Risk Management in Swing Trading

Effective risk management is crucial in swing trading. Here are some techniques to manage risk effectively:

- Stop Loss Orders: Always set stop losses to protect your capital. This should be based on your risk tolerance and the volatility of the asset you are trading.

- Position Sizing: Determine how much capital to risk on each trade and adjust your position size accordingly. This will help you avoid significant losses.

- Risk-Reward Ratio: Establish a favorable risk-reward ratio before entering a trade. A common approach is to aim for at least a 1:2 ratio, meaning the potential profit is twice the potential loss.

Tools and Resources for Swing Traders

To enhance your swing trading success, consider using the following tools:

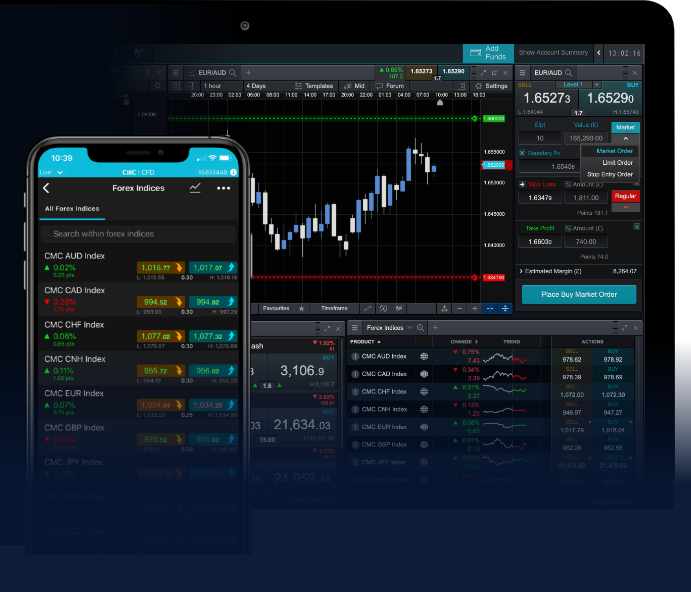

- Trading Platforms: Choose a reliable trading platform that offers advanced charting tools and real-time data. Popular platforms include MetaTrader 4, TradingView, and NinjaTrader.

- Technical Indicators: Familiarize yourself with commonly used indicators and their applications in swing trading. Customizing your indicators to fit your strategy can improve your analysis.

- Educational Resources: Take advantage of online courses and webinars to deepen your understanding of swing trading strategies and market dynamics.

Conclusion

Forex swing trading can be a rewarding approach for individuals looking to profit from market movements without the demands of day trading. By understanding key strategies, implementing robust risk management practices, and utilizing the right tools, traders can maximize their trading potential. As with any trading strategy, continuous learning and adaptation are essential for long-term success. Stay disciplined, remain informed, and continue to refine your skills as you embark on your forex swing trading journey.